There are so many advantages to living abroad: the adventure of diving into a new country and culture, meeting people from around the world, the opportunity to travel. Of course, with those positives, comes a few negatives, like being further away from family and friends, and the time it takes to adapt to a new set of cultural norms (don’t forget our 6 month rule!).

For me, a glaring negative about expat life is the task of filing US taxes abroad. Unlike almost any other country on the planet, the US requires all citizens to file US taxes on income earned, regardless of if they lived in the US during the tax year. It is an annoyance well-known to US expats, and one that garners a few giggles or looks of confusion from non-American expats.

All Americans know the irritation and annoyance that comes from this yearly chore, but when you add on the burden of all the extra paperwork required when living abroad, it is enough to make us want to go hide in a cave somewhere.

Facing April 15th, Americans living abroad have a few options.

First, you can always file taxes yourself. Some people pride themselves in their ability to make sense of the complicated US tax code, and almost relish the paperwork. We are not those people. Honestly, the prospect of making a mistake and being audited (from China, no less) sends us back to our cave.

Another option is to hire one of the large professional tax firms back in the US to file the paperwork for you. The problem is that most of these tax offices are not used to dealing with the complexities of expat taxes, and when it comes to paying your taxes accurately and on time, you want to work with someone that has experience handling the complicated US tax returns of an expat.

Which brings me to the small but mighty category of expat tax specialists including our personal favorite, Taxes for Expats. Taxes for Expats (TFX) deals exclusively with expats and they understand the difficulty of filing US taxes abroad. They even have a guide for helping digital nomads (hello travel blogging friends!) file their taxes.

Why Use Taxes for Expats for Filing US Taxes Abroad

- Expert Human Help: With TFX, you can avoid long, annoying automated messages and speak with an actual person at their call center, which is open 18 hours per day, or use their live chat support.

- Fair, Straight Forward Pricing: The price structure is clearly laid out on the website, starting at $350. No last second surprises or bizarre surcharges you were not expecting, no matter how complex the situation.

- Smart, User-Friendly System: TFX has developed a clear, easy to use client portal to make filing your taxes stress free. There are no PDFs or Excel spreadsheets to download (have you ever tried to download a PDF onto a new country’s sized paper and have it print crazily? Just us?). Everything is integrated right into their system.

- Top Rated Expat Tax Firm: TFX only uses seasoned tax professionals with 10+ years experience. They do not outsource any work outside the US and all tax experts are employees of TFX. In fact, they are the top rated US expat tax firm according to Trustpilot, an independent review site.

The Ease of the Taxes for Expats System

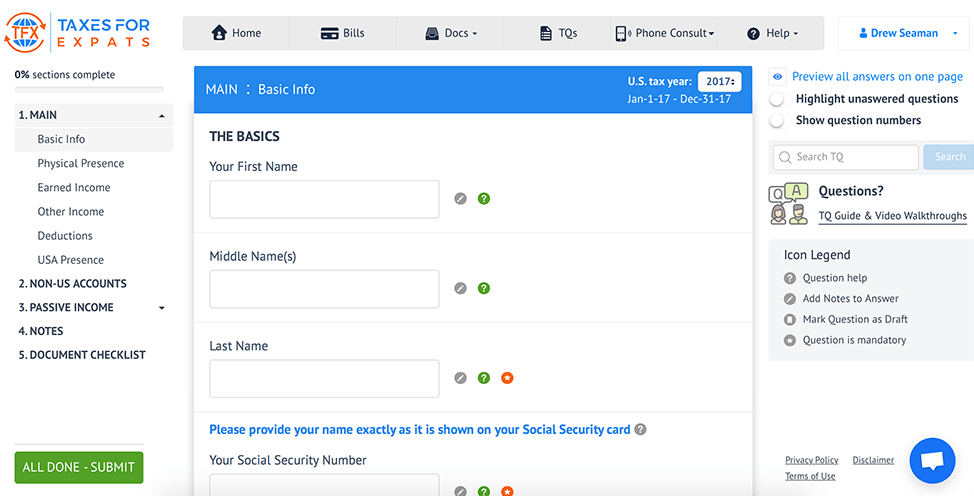

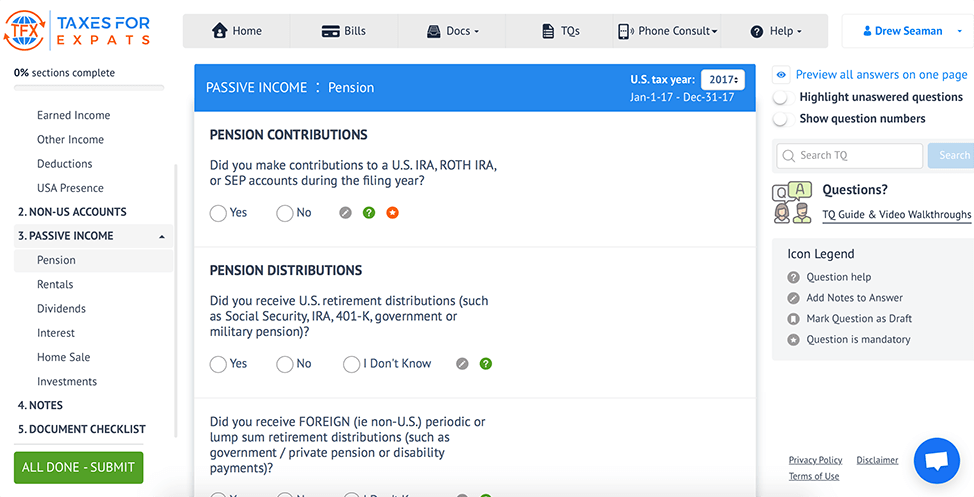

Unlike many online tax software, which is often confusing, especially when dealing with the complication of earning income overseas, TFX has designed an interface that makes this frustrating annual process tolerable-bordering-on-pleasant.

Once you have signed up, you will have access to your Client Area. Everything you need to do with TFX is completed in this area. Their easy to understand tax questionnaire walks you through the tax return process slowly and clearly. It has been tailored to make reporting your overseas income basic to understand. Everything you enter into your TFX tax questionnaire is used to populate your tax return behind the scenes.

If you don’t know the answer to a question, you can even answer ‘I Don’t Know’ and get assistance with it later with customer support.

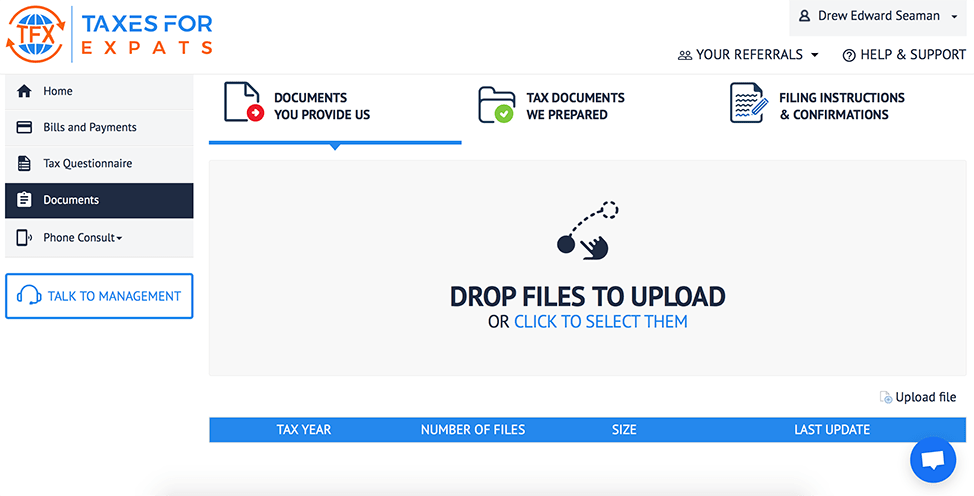

Once you have completed the tax questionnaire, TFX will let you know what documents they need to include with your tax return. You can simply upload any necessary documents to your ‘My Documents’ section of your Client Area.

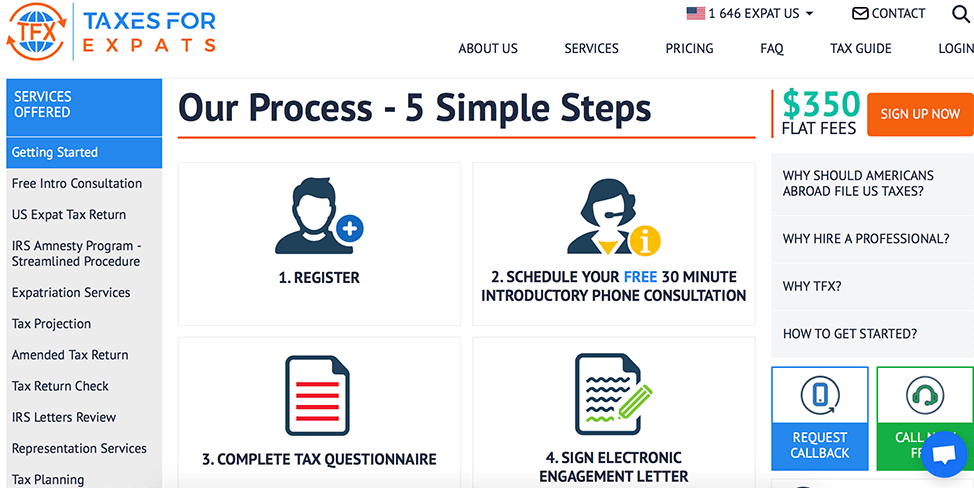

How The Taxes for Expats Process Works

The process of filing your US taxes with TFX is simple:

- Register: The signup process is easy, and takes about 30 seconds. You then immediately have access to your Client Area.

- Schedule a Free 30 Minute Introductory Phone Consultation: Speak to a tax professional to help get you started with TFX and answer any questions you may have. This is especially valuable for first-time US expats filing US taxes aboard, or if you’ve moved to a difficult tax country (ahem, China).

- Complete the Tax Questionnaire: The user-friendly TFX tax questionnaire is easy to understand and quick to fill out. And if any questions arise, the customer support can assist with any issues.

- Sign Electronic Engagement Letter: Once you send over your tax questionnaires and necessary documents, TFX will prepare an engagement letter for you to sign. It will explain exactly what they are doing and the full, total cost before they begin their work.

- Pay and Review Your Tax Return: Once TFX has completed your tax return, they will send it to you for review and payment. Typically turnaround time for taxes is 15 business days. If you are happy to proceed, TFX can e-file your taxes for you from that point.

There is almost nothing in the world I hate as much as doing taxes, and when we decided to move to China, the ease of doing our taxes was a legitimate discussion point on our lengthy Pros and Cons list. Until you’ve faced the burden of filing taxes abroad, the headache of the process can’t be imagined.

Imagine the relief we felt when we found a magical corner of the tax universe dedicated to people just like us!

Whether you choose to go it alone or seek help, TFX is a fantastic resource for providing peace of mind when dealing with your US taxes abroad. If you barely know the difference between Form 1040, 8938, 2555, and 114, then TFX is for you.

Its really great that we have these online tax filing tools that help us to file taxes wherever we are. Whoever started this type of platform is a total genius!

Jamie Cordon recently posted…A Comprehensive Guide on Filing Quarterly Percentage Tax (BIR Form No. 2551Q)

totally agree. Love how user friendly it is, which is something you rarely hear about tax forms!